Find Deed Records in Morgan County

Morgan County deed records are kept at the Probate Court in Decatur. Online access requires registration, and archives date back to 1818. A mobile app is also available for searching records.

Morgan County Quick Facts

Morgan County Probate Court

The Morgan County Probate Judge records all deeds in the county. This office on Lee Street in Decatur handles property recordings and searches. Staff maintain records going back to 1818, which is one year before Alabama became a state. That gives Morgan County some of the oldest land records in Alabama.

Morgan County has grown a lot in recent decades. Decatur and Hartselle are the main cities. The Probate Court serves all areas of the county for deed recording. The office is on the second floor of the county building downtown. Parking is available nearby in public lots.

| Office | Morgan County Probate Court |

|---|---|

| Address | 302 Lee Street NE, 2nd Floor Decatur, AL 35601 |

| Phone | (256) 351-4680 |

| Hours | Monday through Friday, 8:00 AM to 5:00 PM |

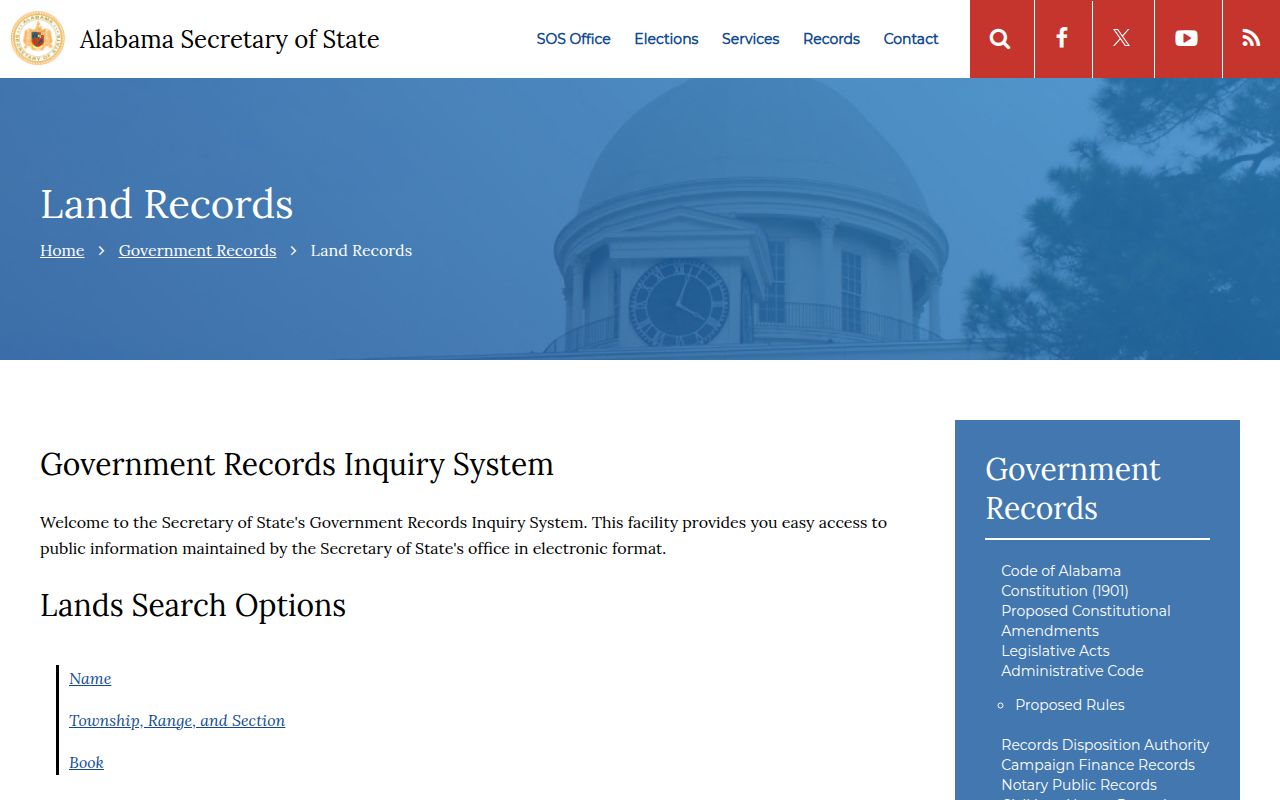

Searching Morgan County Deed Records Online

Morgan County offers online access to deed records, but you need to register first. The system requires creating an account before you can search. This is different from counties that offer free public search without registration. Contact the Probate Court for details on setting up your account.

Once registered, you can search deed records by name, date, or document type. The online system covers many years of recordings. You can find deeds, mortgages, liens, and other property documents. Document images may be available for viewing and downloading.

Morgan County also has a mobile app for searching records. This lets you look up property documents from your phone or tablet. The app connects to the same database as the website. It is a convenient option if you need to search while away from your computer.

Records you can search in Morgan County include:

- Warranty deeds and quitclaim deeds

- Mortgage documents and releases

- Tax liens and judgment liens

- Easements and rights of way

- Plats and subdivision maps

- Powers of attorney

For the oldest records from 1818, you may need to visit in person. Early deed books are kept at the Probate Court. Staff can help you search these historical records. They contain property transfers from before Alabama was a state.

Morgan County Deed Recording Fees

Morgan County charges $9.00 to record the first page of a deed. Each additional page costs $3.00. These fees are about average for Alabama counties. The total depends on how long your document is.

The deed transfer tax applies on top of recording fees. Alabama sets this at $0.50 per $500 of property value. About two thirds goes to the state treasury. One third stays in Morgan County. Exempt transfers include those between husband and wife and certain family gifts.

Recording fees in Morgan County break down as:

- First page: $9.00

- Additional pages: $3.00 each

- Deed tax: $0.50 per $500 value

- RT-1 form: no charge

- Certified copies: additional fee

Every deed needs an RT-1 form. This Real Estate Sales Validation Form shows the sale price or fair market value. The Alabama Department of Revenue requires it on all deed recordings. Without it, Morgan County will not record your document.

How to Record a Deed in Morgan County

Recording a deed in Morgan County means following Alabama's requirements. Your document must have certain information or the Probate Court cannot accept it. Getting everything right saves time and avoids rejection.

Every deed in Morgan County must have:

- Grantor name, address, and marital status

- Grantee name and complete mailing address

- Legal description of the property

- Derivation clause citing the prior deed

- Name of who prepared the deed

- Notarized signatures of all grantors

Bring your completed deed to the Probate Court at 302 Lee Street NE in Decatur. The office is on the second floor. Staff review the document and calculate your fees. You pay the recording fee and any deed tax that applies. The clerk stamps your deed with the recording date and book and page number.

Processing is usually same day in Morgan County. You can wait for your original or come back later to pick it up. Keep the recording information for your records. You will need the book and page number if you ever need to reference this deed again.

Title Searches in Morgan County

Title searches in Morgan County can use the online system once you have an account. Trace property ownership by looking up deeds in reverse order. Start with the current owner and work back through prior sales. Each deed should reference the earlier one.

Morgan County's records go back to 1818. For a complete title search, you may need to check very old deed books. The earliest records are handwritten and kept at the Probate Court. Staff can help you navigate these historical documents.

Beyond deeds, check for mortgages, liens, and other claims. These show up in the same index. A thorough search covers all types of recorded documents that might affect title. Most buyers hire a title company or attorney to do this work.

A Morgan County title search should check:

- Chain of ownership through prior deeds

- Outstanding mortgages

- Tax liens from unpaid taxes

- Judgment liens from court cases

- Easements on the property

- Any restrictions or covenants

Title insurance protects buyers from problems missed in the search. If a claim comes up later, the insurance covers your loss. Lenders require title insurance on financed purchases. Buyers can also get owner's policies for extra protection in Morgan County.

Property Tax Records in Morgan County

The Morgan County Revenue Commissioner handles property taxes. This office assesses values and collects annual taxes. Tax records are separate from deed records but linked through parcel numbers and legal descriptions.

Tax maps show property boundaries in Morgan County. Each parcel has an ID number that connects to ownership and tax data. You can use tax records to help identify a property before searching deeds. The Revenue Commissioner office can provide maps and parcel information.

Unpaid property taxes create liens. These liens are recorded at the Probate Court and show up in title searches. Check the tax status before buying any land in Morgan County. You do not want to inherit someone else's tax problems.

Legal Resources in Morgan County

Real estate attorneys in Morgan County can help with deeds, closings, and title matters. The Alabama State Bar has a lawyer referral service at (800) 392-5660. They can connect you with an attorney who handles property issues.

Legal Services Alabama serves low-income residents of north Alabama including Morgan County. Call (256) 536-9645 or the statewide line at (866) 456-4995 to ask about qualifying for free legal help.

The Morgan County Probate Court staff can answer questions about recording procedures. They explain what documents you need and how the process works. They cannot give legal advice but know the recording system well.

Cities in Morgan County

Morgan County includes Decatur, which is the county seat and largest city. All property records for the county are kept at the Probate Court in Decatur.

Other cities in Morgan County include Hartselle, Falkville, and Priceville. Deed records for all Morgan County properties are handled at the Probate Court on Lee Street.

Nearby Counties

These counties share borders with Morgan County. Make sure your property is in Morgan County before searching here. Land near county lines may be in a neighboring county.