Montgomery County Deed Records

Montgomery County deed records are maintained at the Probate Court in Alabama's state capital. Online records are available from June 1970 to the present through the county's web portal.

Montgomery County Quick Facts

Montgomery County Probate Court

The Montgomery County Probate Judge records all deeds in the county. This is the state capital, so the Probate Court handles a high volume of real estate transactions. The office on South Lawrence Street serves residents of Montgomery and surrounding areas who need to record property documents.

Montgomery County offers some of the lower recording fees in Alabama. At $8.50 for the first page, it costs less than many other counties. The online system with records from 1970 forward makes searching convenient. For older records, you need to visit the Probate Court in person.

| Office | Montgomery County Probate Court |

|---|---|

| Address | 101 South Lawrence Street Montgomery, AL 36104 |

| Phone | (334) 832-1239 |

| Hours | Monday through Friday, 8:00 AM to 5:00 PM |

| Website | Montgomery County Land Records |

Searching Montgomery County Deed Records Online

Montgomery County provides online access to deed records at pjr.mc-ala.org/weblandrecord. The system has records from June 1970 to the present. That gives you over 50 years of property transactions to search from your computer.

The online portal lets you search by grantor name, grantee name, or date range. You can find deed recordings, mortgages, and other property documents. The index shows recording dates and book and page numbers. Document images are available for viewing and downloading.

For records before June 1970, you will need to visit the Probate Court. Staff maintain the older deed books in the office. These go back to when Montgomery County was formed in 1816. The historical records contain important information for long-term title searches.

Documents you can find online in Montgomery County include:

- Warranty deeds and quitclaim deeds

- Mortgage documents

- Mortgage releases and satisfactions

- Liens of various types

- Easements and rights of way

- Plats and subdivision maps

- Powers of attorney

Montgomery County Deed Recording Fees

Montgomery County has lower recording fees than many Alabama counties. The first page costs $8.50 to record. Each additional page is $2.50. These rates make Montgomery County one of the cheaper places to record deeds in the state.

The deed transfer tax applies on all sales. Alabama charges $0.50 per $500 of property value. About two thirds goes to the state and one third stays in Montgomery County. Some transfers are exempt, such as those between spouses or certain family gifts.

Recording fees in Montgomery County are:

- First page: $8.50

- Additional pages: $2.50 each

- Deed tax: $0.50 per $500 value

- RT-1 form: no charge

- Certified copies: additional fee

Every deed in Montgomery County needs an RT-1 form. This Real Estate Sales Validation Form shows the sale price or fair market value. The Alabama Department of Revenue requires it statewide. Your deed will not be recorded without a completed RT-1.

How to Record a Deed in Montgomery County

Recording a deed in Montgomery County follows Alabama's standard rules. Your document must meet certain requirements or the Probate Court will send it back. Getting everything right the first time saves you time and hassle.

Alabama requires these elements on every deed:

- Grantor name with marital status

- Grantor mailing address

- Grantee name and complete address

- Full legal description of the property

- Derivation clause showing source of title

- Name of who prepared the deed

- Notarized signatures of all grantors

Bring your completed deed to the Probate Court at 101 South Lawrence Street in downtown Montgomery. Staff check the document for completeness. Then you pay the recording fee and any deed tax that applies. The clerk stamps your deed with the recording date and book and page number.

Montgomery County processes a large volume of recordings. Wait times can vary depending on how busy the office is. If you have a time-sensitive closing, call ahead to check current processing times. Title companies and attorneys work with the office daily and know the procedures.

Title Searches in Montgomery County

Title searches in Montgomery County can start online for records from 1970 forward. Use the county portal to trace ownership back through recent decades. For a complete search, you may need to visit the Probate Court to check older records.

A basic title search follows the chain of ownership. Start with the current owner and work backward. Each deed references the prior one in its derivation clause. Keep going until you have enough history for your needs. Most purchases check back 30 to 50 years.

Beyond deeds, you also check for mortgages and liens. These claims against property show up in the same index. You want to know about any debts or judgments before buying. A complete search covers all these records.

Title insurance companies operate in Montgomery County. They search the records and issue policies that protect buyers from title problems. If something was missed and causes a loss, the insurance pays. Mortgage lenders require title insurance on financed purchases.

State Government and Property Records

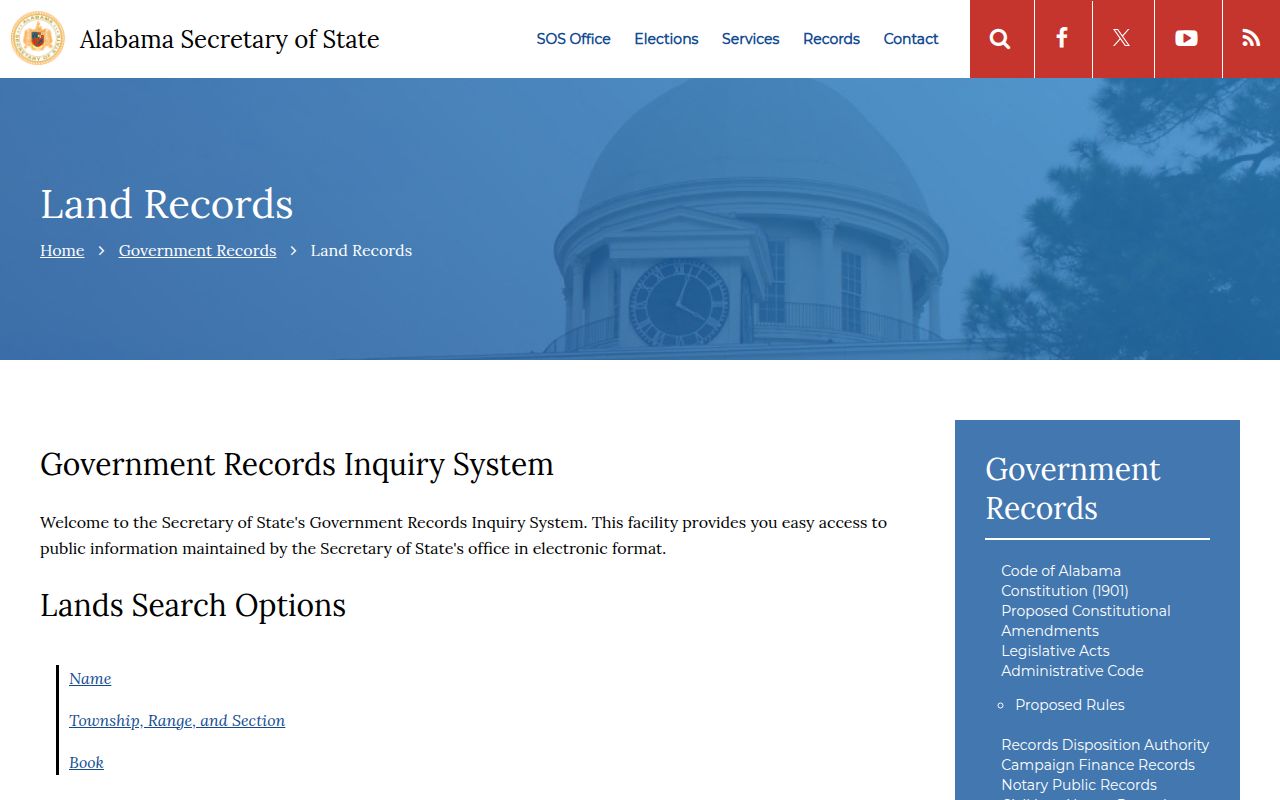

As the state capital, Montgomery has extra resources for property research. The Alabama Secretary of State keeps historical land records from the federal land grant era. These are available online at sos.alabama.gov.

The Alabama Department of Revenue is also in Montgomery. They handle the deed transfer tax program and the RT-1 form requirements. If you have questions about deed taxes, their office can help. The department publishes guidance on what transfers are taxable and which are exempt.

State law libraries and legal resources are nearby in Montgomery. The Alabama Supreme Court Law Library is downtown. It has materials on property law and deed requirements. Anyone can use the library for research during business hours.

Property Tax Records in Montgomery County

The Montgomery County Revenue Commissioner handles property taxes. This office assesses values and collects annual taxes. Tax records are separate from deed records but connected through parcel numbers.

You can look up property tax information online through the county website. Tax maps show parcel boundaries. Each property has an ID number that links to ownership and value data. This helps identify land before searching deed records.

Unpaid property taxes create liens. These show up in the Probate Court records. Check the tax status before buying any property in Montgomery County. Tax sales happen periodically when owners fall far behind on payments.

Legal Resources in Montgomery County

Montgomery has many real estate attorneys who handle property matters. The Montgomery County Bar Association has a lawyer referral service. The Alabama State Bar also offers referrals at (800) 392-5660.

Legal Services Alabama has its main office in Montgomery. They provide free legal help to low-income residents. Call (334) 264-1471 or (866) 456-4995 to ask about qualifying for assistance with property issues.

The Montgomery County Law Library is in the courthouse. It has forms and resources for self-help. Staff can show you where to find information about deeds and property law but cannot give legal advice.

Cities in Montgomery County

Montgomery County includes the city of Montgomery, which is both the county seat and state capital. All property records for the county are kept at the Probate Court downtown.

Other communities in Montgomery County include Prattville (which is mainly in Autauga County) and Pike Road. Deed records for all Montgomery County properties are at the Probate Court on South Lawrence Street.

Nearby Counties

These counties border Montgomery County. Property near the county line may be in a neighboring county. Check the exact location before searching.